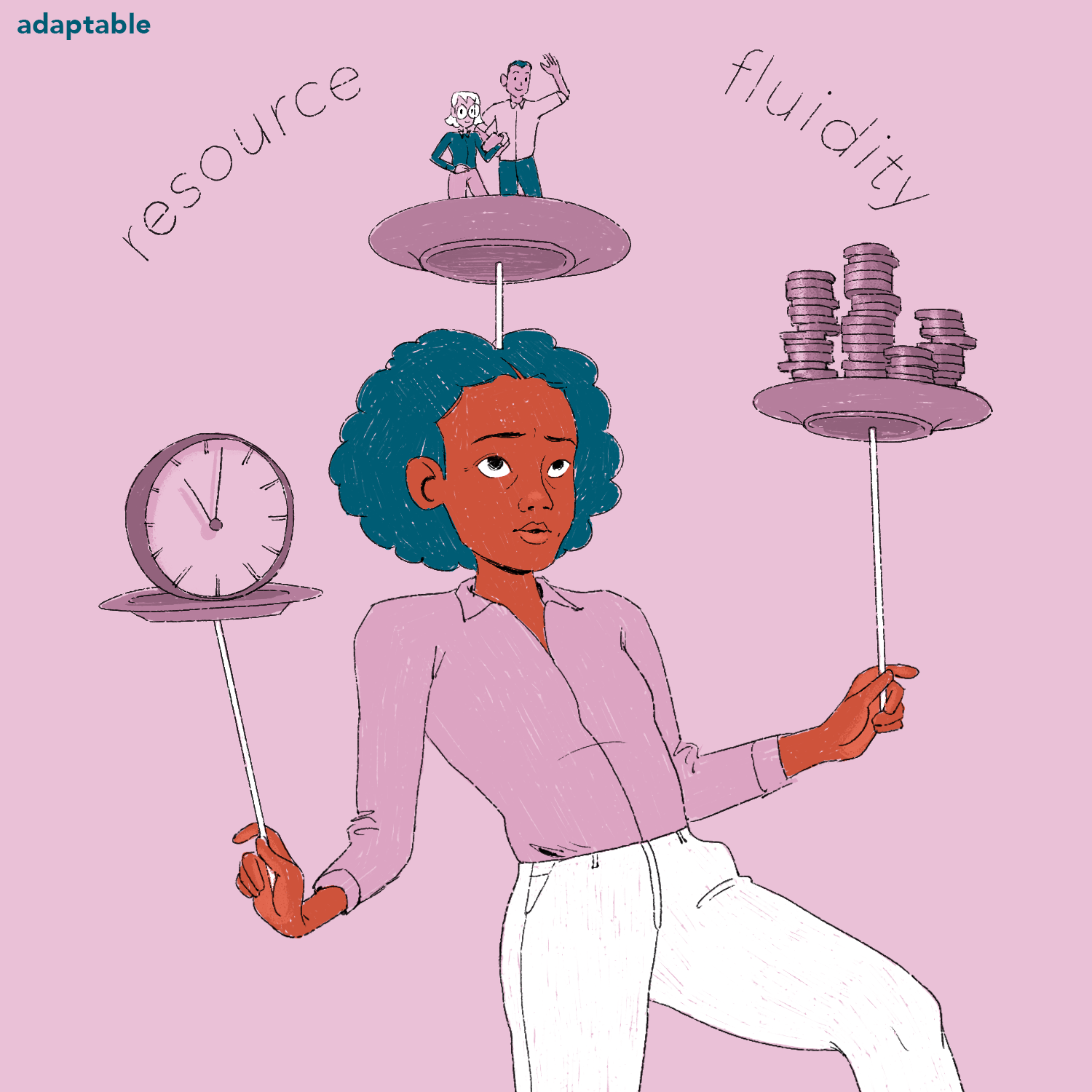

Resource Fluidity

BCG - Sep 13, 2021

Going Beyond Budgeting

CFOs say it’s finally time to slay the three-headed corporate budgeting monster.

McKinsey & Company - Aug 27, 2021

An ecosystem of partners: The foundation of capital project excellence

To deliver large capital projects in heavy industry more efficiently, project owners can consider forming an ecosystem of partners and fundamentally rethinking ways of working together.

Forbes ($) - Aug 20, 2021

Annual Budgeting Is For The Birds

It is finally time to retire annual budgeting and make way for dynamic rolling forecasts.

BCG - Aug 13, 2021

Sustaining a Culture of Cost Consciousness

It’s been a few years since your company launched its zero-based budgeting (ZBB) effort. Thanks to a solid design and full buy-in, it was a success, with only a few bumps in the road. Through roughly 100 savings initiatives, you carved out inefficiencies and redirected funds to the company’s business priorities. Once the implementation was done, everyone wondered: what’s next?

McKinsey & Company - Jul 30, 2021

Three keys to building a more skilled postpandemic workforce

Many companies face large, and growing, skills deficits. A few companies approach skill building in a more integrated way—and are quietly gaining an edge on rivals.

This is a decently deep discussion of project specific risk versus portfolio level risk AND how to manage these risks such that capital is not being held captive as contingency funds/reserves in hundreds of different projects or initiative programs across an organization. I like the way the article puts the burden on executives to look across the portfolio and to create “robust process or consistency between projects”. Great overview of the challenges and opportunities to free up funds as companies begin to invest capital in the post pandemic period (hopefully).

McKinsey & Company - Aug 3, 2021

Managing project portfolios to unlock trapped capital

The COVID-19 pandemic has led many businesses to try to minimize short-term capital outlay; considerable capital can be unlocked by rethinking the way project risk is recognized and funded.

McKinsey & Company - Aug 30, 2021

What does resilience mean in capital and balance-sheet management?

Two partners from McKinsey’s Risk and Resilience Practice share their perspectives on dealing with heightened uncertainty and emerging threats during and after the COVID-19 pandemic.

This article does a great job of summarizing some of the key risks and mitigation efforts to enable what the authors call a “resilient supply chain”. The article also talks (although only briefly) about how resource planning methods can be used to analyze risk and identify mitigation opportunities for early signs of break points (definitely read the sidebar on the medical device company!).

BCG - Jul 29, 2021

Real-World Supply Chain Resilience

For years, companies have focused on eliminating redundancy in sourcing to reduce fixed costs and promote efficiency. Greater efficiency, however, came at the expense of diminished flexibility and effectiveness—a tradeoff the pandemic-induced supply chain disruptions have made painfully clear.

McKinsey & Company - Jul 19, 2021

Into the fast lane: How to master the omnichannel supply chain

Consumer-product and retail companies looking to jump into the fast lane of modern shopping will need to overhaul their operations to master the seven building blocks of an effective omnichannel supply chain.

This is an extremely well-written summary of scenario planning. Having just written a joint post on the same topic, I appreciated the clarity of thought as well as the methods that are outlined. Especially significant were both the lenses for identifying the uncertainties at the beginning of the process and the “signposts” to detect early evidence of marketplace shifts at the end of the process. I would suggest bookmarking this post, so it is ready to be shared with your colleagues.

Bain & Company - Jul 20, 2021

A Strategy for Embracing Uncertainty

There are no crystal balls, but companies can get a lot smarter about envisioning future scenarios and knowing when to act on them.

Though this post is not my traditional type of selection for resource fluidity, this article looks at office space and begins to consider what’s really needed as we begin to get back to convening within physical spaces. The authors review the main reasons for physical office space and then move on to explore the main attributes that should be considered for a reduced footprint. This is a topic on many people’s minds and it greatly impacts resources.

Harvard Business Review ($) - Jul 2, 2021

Do You Really Need All that Office Space?

The pandemic shifted many professionals to work at home. As we emerge from the crisis and companies shift to hybrid work arrangements, they should reconsider the size, location, and design of offices.

The idea of matching talent to strategy is such a basic concept. It’s common sense that organizations need to hire and/or build key capabilities to deliver on future strategy. However, I feel like many businesses are slow to respond. This post mentions how private equity firms build value by aggressively deploying purpose-fit talent against a clearly defined value creation plan (VCP). With this strict intentionality, they outperform their traditional counterparts. Why can’t all organizations do the same?

Bain & Company - Jun 21, 2021

Lack of Talent Isn’t Your Problem. How You Use It Is.

As companies plan for a changing business climate, getting the right talent into a select number of business-critical jobs is key to outperforming the competition.

Here is an article about getting your corporation’s head up to sense the environment, so you can iteratively detect, discuss, & align around a set of commonly held assumptions about the future. I love all articles that challenge teams to understand one another and to share understanding transparently.

Futurealities Limited ($) - Jun 15, 2021

Incorporating ‘Futures‘ Foresight Into The Process Of Strategic Planning

In the authors’ experience a fact of corporate life is that management all too often ignores future uncertainty. And, even if vaguely uncomfortable with this situation, it is unfamiliar with, or even skeptical about, ways to address it. Yet paradoxically the increasing pace of change on many dimensions makes this an ever more critical issue for effective strategic planning.

Harvard Business Review ($) - Jun 15, 2021

Figure Out the Right Hybrid Work Strategy for Your Company

As leaders grapple with how to return their teams to the office, they face an additional challenge when discussing hybridity: What they think is a single discussion is in fact three different discussions in disguise, each with different objectives. It’s a bit like trying to declare a winner among three teams that are each playing a different sport.

Having worked as a facilitator of cross-boundary collaborations focused on solving complex problems, I found this article on joint planning between CPG companies and retailers as a super fun read. The article explores the benefits, the barriers, and the key practices to succeed in this joint work.

Bain & Company - Jun 10, 2021

Growth for Both: How US Brands and Retailers Grow the Profit Pool for All

Manufacturers and retailers can improve joint business planning to help each other thrive amid mounting challenges in a postpandemic world.

Deep dive into scenario planning. Not for the faint of heart, so only go there if you love the topic. The chapter/short book explores characteristics of scenario planning like time horizons, the definition of “uncertainties, what I deem to be the meaning of internally consistent futures, and lots more.

Medium ($) - May 26, 2021

Scenarios: Learning And Acting From The Future

The building of multiple alternative scenarios is justified in a reality dominated by uncertainty and a fast pace of change. If the future was predictable, we wouldn’t have this need to develop and explore scenarios, being the strategic planning and decisions based on a univocal and extrapolation-based forecast.

-

Leveraging Strategic Initiatives to Capture the Future

Initiative management is the planning, overseeing, and sometimes culling of projects to reach a new strategic position in the future.

Medium ($) - Apr 23, 2021

Pretotyping vs. Prototyping — What’s the difference?

One of the most common mistakes made by founders and product developers is building something that they thought people would want, only to find out that their assumptions were wrong.

Great video interview (and complementary article) that discusses Tata Steel and what appears to be a corporate wide transformation initiative focused on value creation and agility. I recommend watching the video in its entirety. Around minute twelve of the video, the speaker transitions into a deep dive on their work to enhance both their demand planning and their sales and operations planning. I loved the way that Dr. Svend Lassen of Tata Steel speaks to the enhanced visibility, the evolving cross-boundary collaboration, and the value capture from developing better PLANNING. I’m sure it was a ton of work, but it’s exactly what we should be seeing at all of our corporations! Nice work.

Anaplan - Apr 19, 2021

The growth driver — S&OP the ultimate engine aligning business plans

Given ongoing challenges of disruption, some S&OP processes may be constrained while other elements are proven essential to planning with agility. One of the key benefits of S&OP is collaboration across functional areas of the organization. Anaplan and Tata Steel discuss the importance of aligning strategy and execution to increase revenue for the business while leveraging S&OP to navigate uncertainty.

I know that this is not a traditional resource planning or resource allocation article, but it may be a new way for all of us to think about shared resources! This article lays out how businesses are leveraging one another’s resources to conduct business. It’s a variation on ecosystems … but not really. In this article, the authors discuss how businesses are taking advantage of idle capacity, tangible and intangible, of their peer companies so they can “do better with less”. They say that the B2B shared economy could be a trillion dollar market. I love the myriad of examples that the authors highlight.

Fast Company ($) - Apr 14, 2021

The sharing economy’s next target: Business-to-business

Some parts of the sharing economy took a big hit during the pandemic. But businesses sharing with other businesses is poised to be an incredibly lucrative model for the future.

All Time Favorites

Harvard Business Review ($) - Feb 1, 2003

strategy+business ($) - May 25, 2010

Harvard Business Review ($) - Nov 1, 2001

George Veth

Budgeting has to evolve. I’ve been a secret fan of practitioners, Bjarte Bogsnes (one of the authors) and Steve Morlidge, over the years. These guys have been pioneering new approaches to planning, and this article lays out the key highlights. Every leader should understand these points about target setting, forecasting, and resource allocation.