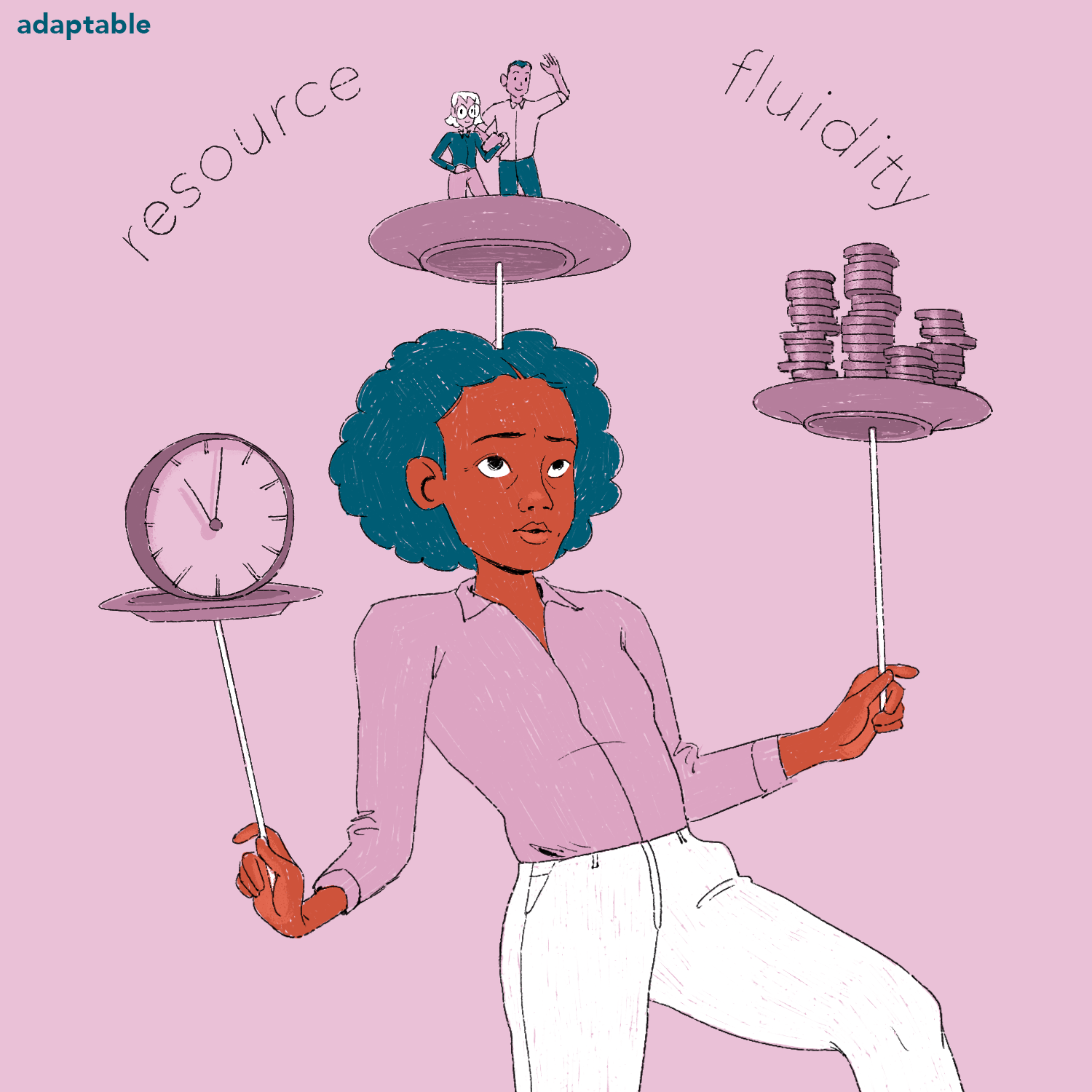

Resource Fluidity

Harvard Business Review ($) - Apr 2, 2021

Research: How to Get Better at Killing Bad Projects

Most innovation managers know that few of their initiatives will succeed, so they keep multiple projects running at the same time and create processes for quickly separating winners from losers. One popular way to make decisions about what stays and what goes is the use of stage gates. Yet, even with stage gates, firms struggle to kill bad projects. The authors undertook a decade-long review of the product development portfolio at former handset maker Sony Ericsson. They found that that the conventional use of stage gates can actually be part of the problem, impeding project discontinuation in counterintuitive ways.

Duke Corporate Education - Mar 1, 2021

Five Steps for Business Impact

Creating value is about exceeding expectations. For any business decision, we must understand the expectations of the decision-maker, and provide a path to exceed those expectations. For leaders and managers seeking approval from their colleagues in the finance function for new projects and initiatives, this is an increasingly urgent priority, because organizations are looking ever more closely at the ‘business impact’ of their resourcing decisions.

Forbes ($) - Feb 23, 2021

What Business Leaders Can Learn From Artists About Navigating An Uncertain World

Complexity is the defining business and leadership challenge of our time. But it has never felt more urgent than this moment, with the coronavirus upending life and business as we know it. Since March, we’ve been talking to leaders about what it takes to lead through the most complex and confounding problems, including the pandemic. Today we continue our conversation with Margaret Heffernan (Read Part 1 here), author of Uncharted: How to Navigate the Future.

McKinsey & Company - Feb 10, 2021

Capital Projects 5.0: Reimagining capital-project delivery

What could your business achieve if your large capital projects were 30 to 50 percent faster and cheaper? The opportunity is more real than you think.

PWC - Feb 1, 2021

How much does it cost to make a product? Many manufacturers don’t know … and it’s costing them

Product costing. A lost art?

McKinsey & Company - Feb 3, 2021

Transformation in uncertain times: Tackling both the urgent and the important

A sprint-based transformation approach can help organizations achieve full potential.

Bain & Company - Jan 28, 2021

Support and Control Functions Go Agile

Support and control functions like human resources and finance can empower Agile teams and benefit from becoming more Agile themselves.

McKinsey & Company - Jan 22, 2021

Building a digital bridge across the supply chain with nerve centers

Many companies operate some type of supply-chain control tower, but upgrading to a digital, end-to-end nerve center can manage risk even more effectively, while boosting output and productivity.

McKinsey & Company - Jan 19, 2021

Scenario-based cash planning in a crisis: Lessons for the next normal

In our experience, leading players connect their internal finance systems with digital tools in the boardroom for agile impact modeling. Getting the scenario approach right is fundamental in these models, and five best practices have emerged.

E&Y - Jan 4, 2021

Why now may be the time to start a corporate venture fund

CVC [corporate venture capital] can be a good tool for staying current on emerging trends and technologies, identifying growth areas, de-risking M&A, and moving faster than traditional R&D. Companies might consider CVC investing to reap future benefits from new products, technologies and geographies.

Harvard Business Review ($) - Feb 1, 2003

Who Needs Budgets?

Budgeting, as most corporations practice it, should be abolished. That may sound like a radical proposition, but it would be merely the culmination of long-running efforts to transform organizations from centralized hierarchies into devolved networks that allow for nimble adjustments to market conditions.

strategy+business ($) - May 25, 2010

Cleaning the Crystal Ball

Peter Drucker once commented that “trying to predict the future is like trying to drive down a country road at night with no lights while looking out the back window.” Though we agree with Drucker that forecasting is hard, managers are constantly asked to predict the future — be it to project future product sales, anticipate company profits, or plan for investment returns. Good forecasts hold the key to good plans.

Harvard Business Review ($) - Nov 1, 2001

Corporate Budgeting Is Broken—Let’s Fix It

Corporate budgeting is a joke, and everyone knows it. It consumes a huge amount of executives’ time, forcing them into endless rounds of dull meetings and tense negotiations. It encourages managers to lie and cheat, lowballing targets and inflating results, and it penalizes them for telling the truth…

All Time Favorites

Harvard Business Review ($) - Feb 1, 2003

strategy+business ($) - May 25, 2010

Harvard Business Review ($) - Nov 1, 2001